Government spending around the world is soaring in response to the COVID-19 crisis. Rising spending coupled with collapsing tax revenues could soon drive up fiscal deficits as well as government borrowing (Kapoor and Buiter, 2020), posing a potential threat to budget balances. The consequences of rising fiscal deficits and debt-to-GDP ratios would be severe if low interest rates were not maintained in the future. In addition, public finances would be vulnerable to shortfalls in growth and other shocks. In the aftermath of the crisis, putting the debt-to-GDP ratio on a downward path will become the new priority (Barnes and Casey, 2020).

In the menu of options for renormalising public debt levels (Reinhart et al., 2015), fiscal consolidation, or austerity, has gained renewed popularity. Some countries have already enacted, or are considering enacting, austerity measures to cope with the rise in debt-to-GDP ratios. Other countries are opposing it, with some commentators blaming austerity policies for the slow recovery in Europe after the Great Recession (Ilzetzki, 2020).

Amid the reignited interests in austerity, policymakers have increasingly called for cooperation in fiscal policies across nations (OECD, 2020). Although prior research has delivered evidence on the domestic consequences of austerity, such as those on economic output (e.g. Ramey, 2011) and investment (e.g. Alesina et al., 2002), much less is known about the effect on economies outside the austerity country. At the micro level, few studies have empirically tested the transmission of fiscal consolidations among firms located in different countries. At the macro level, the channels that propagate such policies across national borders have yet to be established.

In a recent paper (De Vito et al., 2020), we seek to fill this gap. We start by asking whether and how firms’ investment activities react to fiscal policy shocks emanating from abroad. We focus on multinationals’ internal networks of subsidiaries, because prior studies show these networks contribute to the transmission of non-local economic shocks (Cravino and Levchenko, 2017). Moreover, the intra-firm trade of multinationals represents one of the most important forms of economic connections between countries. In the second step, we explore macro implications by assessing the quantitative importance of the spillover for aggregate economic activities such as a country’s investment and employment.

The expected effect of austerity spillover is not obvious. On the one hand, a local subsidiary exposed to a foreign austerity shock could increase its own investment activities because the parent company shifts resource allocations to the local business unit, given that austerity presents a negative shock to the company’s operations in that foreign country (Giroud and Rauh, 2019). On the other hand, such shocks could disrupt the existing production linkage within a multinational’s internal networks and negatively affect a multinational’s internal capital market or business confidence, thereby curtailing a local subsidiary’s investment.

To answer our research question, we rely on the datasets built by Devries et al. (2011) and Alesina et al. (2015) and gather fiscal consolidation episodes that occurred in 14 Eurozone countries from 2004 to 2014. Crucial to our identification, the passage of these (foreign) fiscal consolidations (different types of tax hikes or government spending cuts) is independent of the economic conditions in the destination country where a subsidiary operates. This feature allows us to separate the effect of fiscal policy shocks from confounding economic prospects in driving firms’ resource allocations.

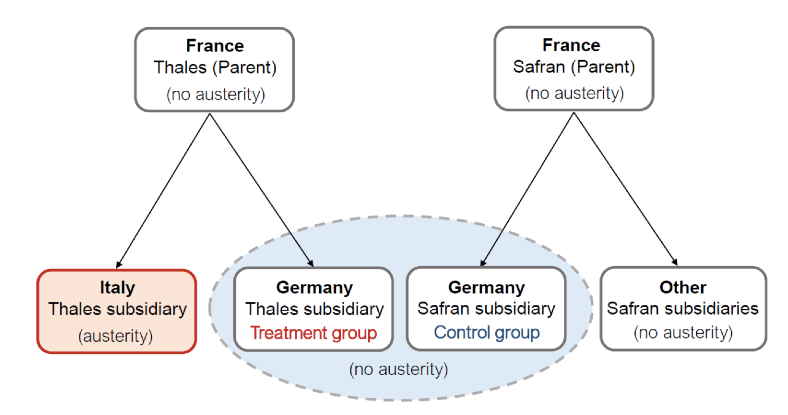

Our empirical approach relies on comparing the investment decisions of two subsidiaries in the same (non-austerity) country and same industry, with one subsidiary having ties to an austerity country, and the other not. We require the two subsidiaries under comparison to have a parent firm headquartered in the same foreign country, absent fiscal consolidation. This condition enables us to separate common factors from the parent country that could affect the investment of the subsidiary.

To understand our approach, consider the Germany subsidiaries of two firms: Safran and Thales. Both Safran and Thales are key manufacturers in the aerospace sector, headquartered in France. In 2005, Italy, where Thales held substantial operations while Safran did not, entered into an austerity plan. This exposed Thales’ German business to a foreign fiscal policy shock via its internal network. Importantly, in the same year, France (the parent country), Germany (the subsidiary country), and the other countries where Safran operated did not undergo any shifts in fiscal policies. Figure 1 provides an illustration. We ask the following key question: Does Thales’ German subsidiary adjust capital investment relative to Safran’s German subsidiary in response to the Italian austerity?

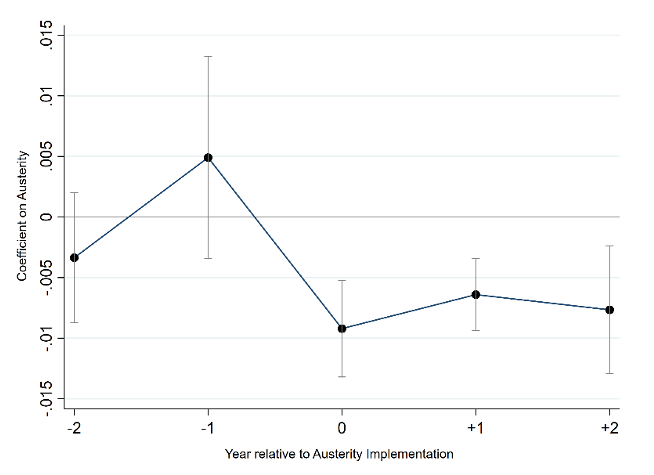

As shown in Figure 2, we find negative investment spillover. That is, in our example, we find that Thales’ German subsidiary reduces investment significantly more than Safran’s German subsidiary does in the year of fiscal shocks. This effect is economically sizeable: our analyses imply investment elasticities of -0.30 to -0.33. Importantly, the effect is not driven by common shocks to the countries or industries in which the subsidiary or the parent firm is operating, because we saturate our empirical model with highly granular matched-pair fixed effects. We thus effectively compare the investment of business subsidiaries facing the same local and parent-level shocks but exposed to different levels of fiscal policy shocks in a third source country.

We further decompose fiscal adjustments into two categories—public spending reductions and tax hikes—and test the magnitude of the spillover for each component. We find that the tax effect is more than four times as large as the effect of spending cuts. Additionally, we show that what matters are subsidiaries’ linkages to a contemporaneous foreign fiscal shock: past or future fiscal adjustments in the austerity country generate virtually zero spillover.

We then explore three distinct channels to understand this phenomenon. We first consider intra-firm production linkages. To the extent that some subsidiaries are set up as suppliers to other subsidiaries located in a different country, shocks to these suppliers ultimately transmit to their customers in the same network (Acemoglu et al., 2012). Consistent with this conjecture, we confirm significantly stronger spillover to subsidiaries that are likely customers of the subsidiaries in the austerity country. Interestingly, we find that foreign policy shocks mainly propagate downstream from suppliers to customers, but not the other way around. This observation is in line with the argument by Briganti et al. (2018), that tax hikes are primarily supply shocks that transmit downstream. We also find that as the multinational’s business confidence dampens, the subsidiary exposed to foreign austerities suffers from a greater decrease in investment. Furthermore, we find that subsidiaries belonging to a financially constrained multinational exhibit larger elasticities of local investment with respect to foreign fiscal consolidation.

Next, we assess how important austerity spillovers are for the economy in the aggregate. The simple observation of spillover to individual subsidiaries might not matter at the country level if the investment loss in those subsidiaries is substituted for increased investment activities in other domestic firms. To address the question, we consider the aggregate investment of all firms in the same country and industry. Similar to our findings at the subsidiary level, we document a significant decline in aggregate investment when a greater share of local firms is linked to foreign austerity countries: an increase of one standard deviation in the foreign austerity share translates into an investment reduction of approximately EUR 36.3 million for a given country–industry. Hence, micro-level spillover effects manifest themselves as an aggregate investment loss.

Finally, in a similarly designed analysis, we find that subsidiaries decrease their employment in response to austerity exposure. As in the investment analysis, we also document an overall decline in aggregate hiring activities when a greater share of domestic firms is exposed to foreign austerities. Again, these findings suggest that austerity spillover matters for the domestic economy.

To conclude, with new episodes of fiscal consolidation looming in a post-crisis environment, we visit this fundamental policy issue with a refreshed view. Echoing world leaders’ call for a coordinated approach in fiscal plans, we show that austerity policies transmit across national borders and cause sharp drops in investment and employment even in countries that do not implement them. Considerations of such spillover effects should be factored in in future policy agenda.

Antonio De Vito is an assistant professor of accounting at IE Business School, IE University; Madrid. He received ta PhD in business and economics from WHU – Otto Beisheim School of Management. Prof. De Vito was visiting scholar at UNC Kenan-Flagler Business School. His research lies at the intersection of economics, finance, and accounting, with special attention to taxation-related topics. Visit his webpage.

Martin Jacob is Adidas professor of finance, accounting, and taxation, WHU – Otto Beisheim School of Management, where he is a faculty member since 2010. He has published in the leading finance and accounting journal and has (co-) authored several policy reports for Sweden on tax policy. His research lies at the intersection of economics, finance, and accounting, with special attention to the effect of taxation on businesses. Visit his webpage.

Guosong Xu is an assistant professor of finance at Erasmus University’s Rotterdam School of Management and a researcher at the Erasmus Research Institute of Management (ERIM). He received his PhD from WHU Otto Beisheim School of Management in Germany and was a visiting scholar at Stern Business School, New York University. His research interests lie in the area of corporate finance, political economics, and behavioural finance. Visit his webpage.

Antonio De Vito is an assistant professor of accounting at IE Business School, IE University; Madrid. He received ta PhD in business and economics from WHU - Otto Beisheim School of Management. Prof. De Vito was visiting scholar at UNC Kenan-Flagler Business School. His research lies at the intersection of economics, finance, and accounting, with special attention to taxation-related topics.

Martin Jacob is Adidas professor of finance, accounting, and taxation, WHU – Otto Beisheim School of Management, where he is a faculty member since 2010. He has published in the leading finance and accounting journal and has (co-) authored several policy reports for Sweden on tax policy. His research lies at the intersection of economics, finance, and accounting, with special attention to the effect of taxation on businesses.

Guosong Xu is an assistant professor of finance at Erasmus University's Rotterdam School of Management and a researcher at the Erasmus Research Institute of Management (ERIM). He received his PhD from WHU Otto Beisheim School of Management in Germany and was a visiting scholar at Stern Business School, New York University. His research interests lie in the area of corporate finance, political economics, and behavioural finance.

Posted In: Economics and FinanceThis site uses Akismet to reduce spam. Learn how your comment data is processed.