Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

Mortgage servicing rights (MSR) are a specific arrangement where a third party promises to collect mortgage payments on behalf of a lender in exchange for a fee.

A mortgage is a form of a loan or debt instrument that is secured by the collateral of a piece of real estate property. If a party wishes to purchase property but lacks enough funds to purchase the property, a lender can offer the purchaser a mortgage loan.

Mortgage loans are used to pay for the property; however, the borrower now owes the lender the principal (amount borrowed) and interest (compensation for lending). The lender is secured because if the borrower defaults or unable to repay the loan, the lender can take possession of the property and sell it to cover its loss.

As mortgage payments are made over the term of a mortgage, there are associated administrative duties and tasks known as mortgage servicing rights. The tasks include the following:

A mortgage lender may outsource the tasks to a third party in exchange for a fee. The third-party will then collect monthly payments, allocate the principal and interest, manage insurance fees, etc. on behalf of the mortgage lender. It is important to note that the third party maintains the right to collect the payments but does not keep the payments. The payments must still be sent back to the original mortgage lender.

For the borrower, the substance of the original contractual arrangement with the lender remains the same. The only difference would be that the borrower is now sending payments to a third-party instead of the lender. In addition, the point of contact for information about the mortgage would be the third-party company as well.

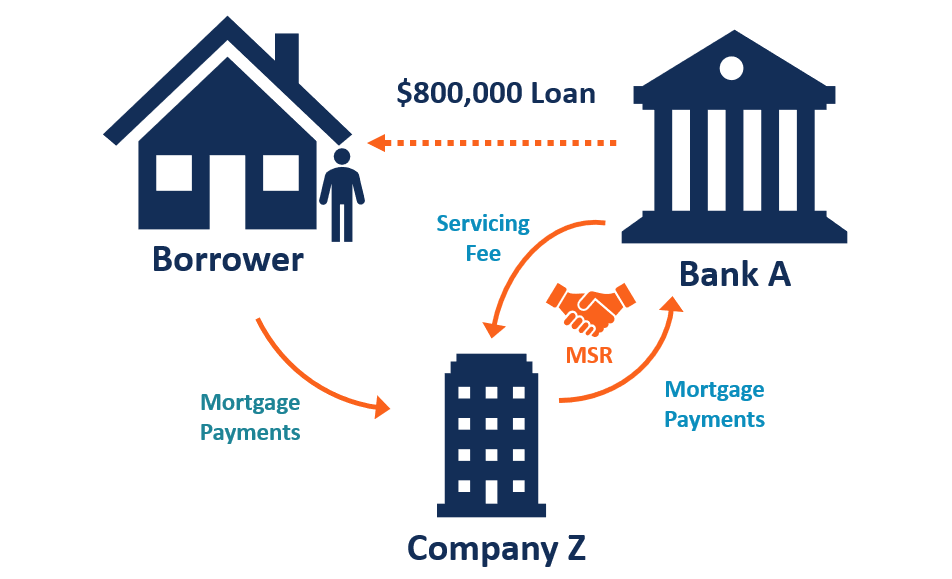

As an example, consider an individual who wishes to purchase a $1,000,000 property. The individual puts a down payment of $200,000 and borrows the remaining $800,000 in the form of a mortgage loan from Bank A. The mortgage term is over 25 years, and the individual pays a fixed interest rate of 5%.

Each month, the individual sends the mortgage lender a payment with the principal and interest included. However, within ten years, the mortgage lender does not wish to hire employees to process mortgage payments anymore.

The mortgage lender proceeds to transfer its mortgage servicing rights to a third-party company, Company Z. Through the arrangement, Company Z will collect the mortgage payments on behalf of Bank A from the individual. Bank A will compensate Company Z for their services with a flat fee.

Most banks and mortgage lenders originate a very high volume of mortgages to many different individual borrowers. Therefore, it can become very costly and time-consuming for the mortgage lenders to service each of the loans.

By transferring mortgage servicing rights, it allows banks and mortgage lenders to devote more resources to their primary business of originating and disbursing new mortgage loans.

In addition, the third-party servicing company can earn a profit without having to bear any risk of owning mortgage loans – they simply specialize in the collection of payments and other mortgage servicing activities.

Mortgage servicing rights represent a significant revenue source for many independent mortgage banking companies and community banks.

Given the dynamic interest rate environments, mortgage servicing rights create a natural hedge or protection on the supply side of the mortgage lending business. When interest rates rise, there are fewer prepayments, and the value of mortgage servicing rights increases. However, when interest rates are low, the prepayment speed increases, and the value of mortgage servicing rights decrease.

Prepayments are when a borrower decides to pay back more than the required principal according to a loan agreement. When interest rates are low, borrowers may wish to prepay their loans quickly so that they can refinance at a lower interest rate. The reverse is true when interest rates are high; borrowers will not want to prepay their loans and refinance at a higher interest rate. It poses a risk to mortgage lenders, which they can offload to a third party with mortgage servicing rights.

CFI offers the Commercial Banking & Credit Analyst (CBCA)™ certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant resources below: