Accrued expenses are expenses that have been incurred (i.e., whose benefit or services have already been received) but which have not been paid for.

An alternative definition of accrued expenses is that they are expenses that have been incurred but not recorded, necessitating adjusting entries and the inclusion of items such as interest expenses, salary expenses, and tax expenses.

Most businesses record expenses in their books of accounts only when they are paid. For example, the first accounting entry to record an electricity expense is made not when an electricity bill is received, but when it is paid.

Thus, in most cases, the balances on expense accounts such as electricity, telephone, and wages, as shown in the year-end trial balance, represent the amounts actually paid out during the year.

It is common for bills to be received after the end of the year, which actually relate to a service received before the year-end.

The trial balance will, of course, have no record of the bill, and yet it would be wrong to ignore the expense involved when preparing the year's profit and loss account.

Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred in one accounting period that will be paid in subsequent periods.

Adjusting entries must be made for these items in order to recognize the expense in the period in which it is incurred, even though the cash will not be paid until the following period.

Like accrued revenues, the accrued expenses occur continuously. However, to simplify the accounting process, they are recorded only at the end of the accounting period. This is performed by recognizing an accrued payable and a corresponding expense item.

Consider the example of Mr. John, a wholesaler. Mr. John installed a telephone in his shop in August 2019. He received the following bills:

The bill for December had not been received by 31 December 2019 when the ledger was balanced and a trial balance extracted. The telephone account, therefore, showed a Dr. balance of $3,460 (as above).

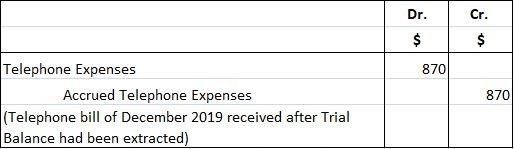

After the trial balance had been drawn up, the December bill arrived, which was for $870.

The situation, therefore, is that the trial balance states that telephone expenses for the year amounted to $3,460; however, in fact, the true telephone expense for the year was $4,330 ($3,460 + $870).

Even though the December bill has not been recorded in the books, the fact is that the service has been received, and hence expenses incurred.

Secondly, there also is the fact that despite the absence of a disclosure in Mr. John's trial balance, on 31 December 2019 he owes $870 to the telephone company for services that have already been consumed.

It follows, therefore, that Mr. John's trial balance must be adjusted for two details:

The accounting entry required to bring accrued expenses to books is:

With the amount of accrued expense in Mr. John's Case, the journal entry would be:

John Accrued Expenses" width="514" height="149" />

John Accrued Expenses" width="514" height="149" />

The effect of the above journal entry would be twofold:

The journal entry for accrued interest expenses corresponds to the entry for accrued interest revenue. However, in this case, a payable and an expense are recorded instead of a receivable and revenue.

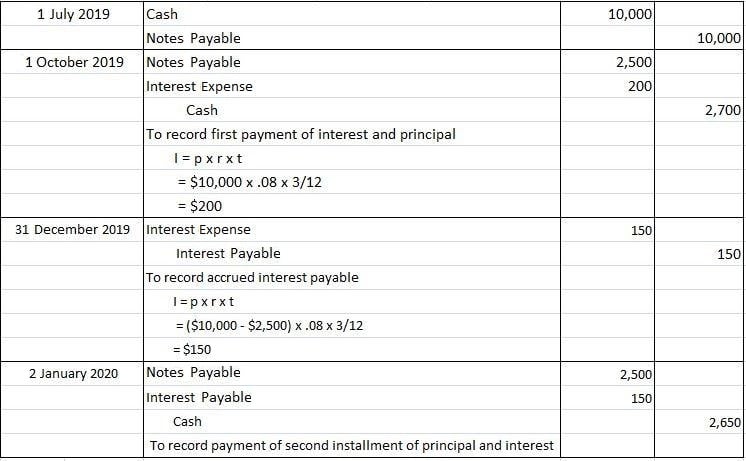

For example, suppose that on 1 July 2019, Dogget Company borrowed $10,000 from a local bank. Both the principal and interest are payable in four quarterly installments, beginning on 1 October 2019.

The series of journal entries through 2 January 2020, including the 31 December 2019 adjusting journal entry, is given in the table below.

In the above example, the note and the interest are paid quarterly. The interest is based on the previous outstanding principal balance of the note.

Therefore, on 1 October 2019, the interest expense is $200, or 8%, of $10,000 for 3 months. The interest expense for the next quarter is based on the new balance in the notes payable account of $7,500.

An adjustment must be made on 31 December 2019 to record the interest expense that was incurred between 1 October 2019 and 31 December 2019. However, this will not be paid until 2 January 2020.

Finally, the journal entry on 2 January 2020 reflects the second payment of principal and interest.

Salaries expenses are another example of accrued expenses for which adjusting entries are normally made. An adjustment is necessary because the date that the salaries are paid does not necessarily correspond to the last date of the accounting period.

Therefore, accrued salaries payable must be recorded for salaries earned by employees but that are unpaid through the end of the accounting period.

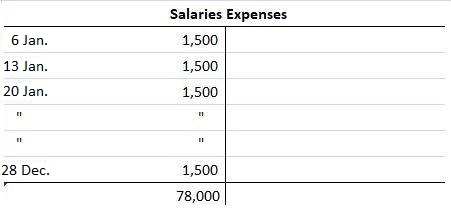

For example, suppose that a firm pays its salaries every Friday for the workweek ending on that day.

For simplicity's sake, also assume that the firm began operations on Monday 2 January 2017. The first payday of the year was Friday 6 January 2017 and the weekly salaries total $1,500.

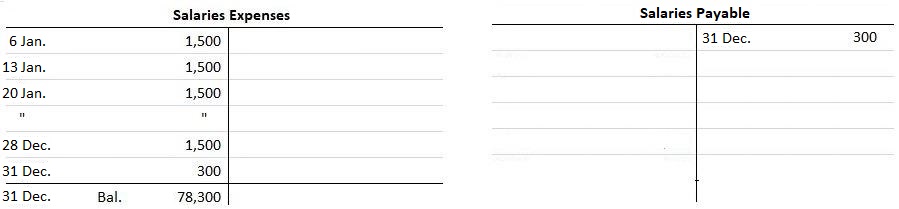

After the last full week of the year on 28 December 2017, the salaries T account appears as follows:

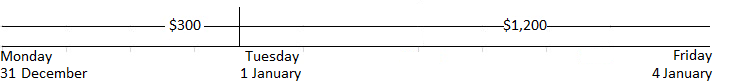

Since the payday for the week beginning Monday 31 December 2017, is not paid until Friday 4 January 2018, it is necessary to make an adjusting entry to accrue salaries through 31 December 2017.

This requires an entry to debit salaries expense and to credit salaries payable. In this case, the amount of accrued salaries on 31 December 2017 is for one day's salaries, or $300 ($1,500 / 5 days — $300).

The salaries for the next 4 days of the week, or $1,200, are the expense of the next year, 2018.

The timeline below shows the total amount of salaries expense for the week ended Friday, 4 January 2018. It also indicates how much expense should be allocated between the two years.

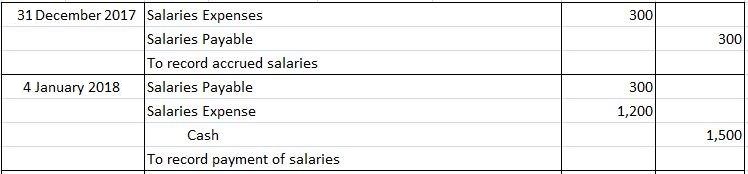

Finally, the adjusting journal entry on 31 December 2017, along with the entry to record the payment of salaries on 4 January 2018, is given below with T accounts.

When the salaries are paid on 4 January, the cash account is credited for the full week's salaries. Salaries payable is debited for the salaries recognized in the prior period, while salaries expense is debited for the current period's salaries.

The purpose of Adjusting Entries to accrue an expense is to recognize an expense as it occurs. The sum of all such adjustments for a period represent the total amount of expenses accrued by a company.

Interest and salary expenses are accrued because the date that these items are paid does not necessarily correspond to the last day of the accounting period. For example, interest is often paid on a monthly or quarterly basis, while salaries are normally paid at regular intervals for work completed within the given period.

The asset used in accruing interest expense is a note payable. A company records an increase in this liability each period as the amount of accrued interest increases.

An adjusting entry for accrued salaries expenses is made to recognize the wages earned by employees but not yet paid. For this purpose, a credit to salaries payable and a debit to salaries expenses are necessary.

To record accrued interest expense, an adjusting entry debits notes payable for the amount of accrued interest, while a credit to accrued interest revenue is made on the income statement. A debit to interest expense and a credit to cash are also made simultaneously, as the accrued interest payable must be paid in cash.

About the Author

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Content sponsored by 11 Financial LLC. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from 11 Financial upon written request.

11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

© 2024 Finance Strategists. All rights reserved.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.