Cash management is the process of collecting and managing cash flows from operating, investing and financing activities. A cash management system allows you to manage cash handling from end-to-end and help automate it through to reconciliation. As such, it is one of the most vital aspects of a company's financial stability.

Learn about how an effective cash management system can keep you ahead of the game. Download our guide today.

The global fallout from COVID-19 highlighted the extreme importance of preserving liquidity during turbulent times. Even though the worst of the pandemic is behind us, companies have become more aware that the threat of new downturns is never far away.

It has become clear that those companies who have developed an effective cash management system will be best positioned to navigate through economic disruptions and emerge in a stronger position.

In this guide, we'll look at the components of an effective cash management system, and the benefits of properly administered treasury management. We'll cover the importance of utilizing real time data and analytics to empower businesses to build a better cash management system. And we'll look at the processes that can facilitate immediate cash conservation, and strengthen long-term liquidity control.

In many industries, cash is the key to being competitive, maintaining financial flexibility and pursuing potential growth opportunities. Market trends are changing rapidly, and consumer preferences and demands are shifting, but one thing is still clear: cash remains king.

In any organization, CFOs, business managers and corporate treasurers oversee cash management strategies, stability analyses and other cash-related activities within the company. As a business grows however, some companies may choose to relinquish internal controls and outsource all or part of their cash management processes to service providers.

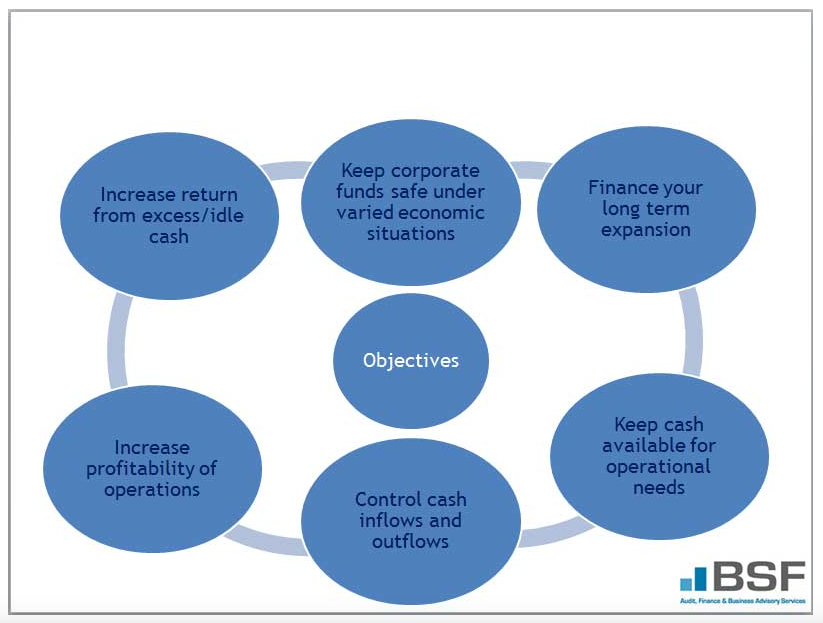

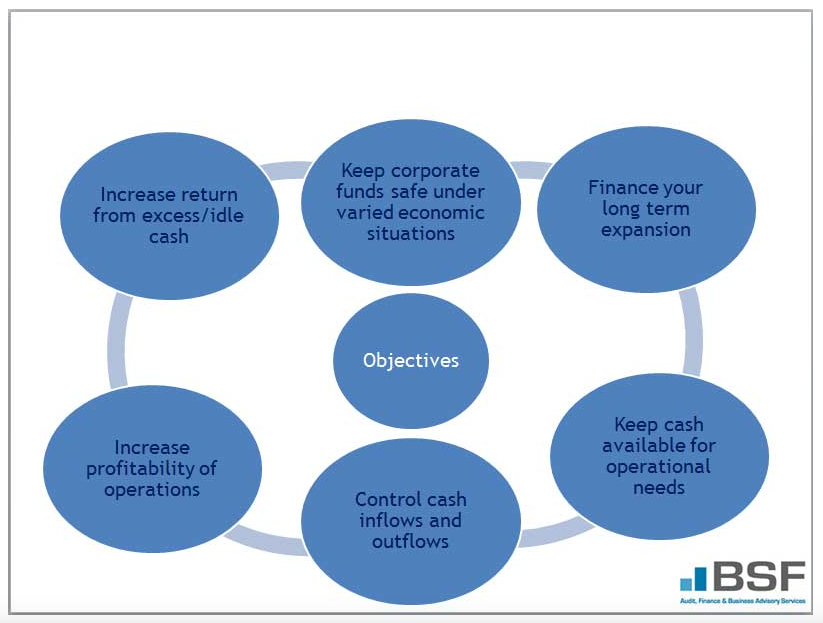

Either way, to create an effective cash management system, organizations need to consider the following:

Without these key considerations, a business could be missing out on opportunities to hit their free cash targets, reduce costs, increase shareholder returns and fund business growth.

Liquidity refers to both an enterprise's ability to pay short-term bills and debts and a company's capability to sell assets quickly to raise cash. The following four cash management strategies are important for immediate cash conservation and managing long-term liquidity.

Cash flow forecasting, also known as cash forecasting, is a way of estimating the flow of cash coming in and out of an entire business over a given period of time. A cash flow forecast shows projected cash based on income and expenses, and is a valuable means of making decisions about funding, capital expenditure and investments.

Tips for achieving outcomes:

Scenario modeling is a method of strategic financial planning that enables finance leaders to mitigate risk and prepare for volatility.

Scenario modeling allows organizations to plan for inherent future uncertainties by quantifying the financial and operational implications of change. By analyzing a range of possible outcomes, the process can identify the key drivers of change for an organization, and calculate an array of projections based on potential variations in performance. The results can be analyzed to determine the best way to apply those results to the organization’s long-term financial and strategic plans.

Tips for achieving outcomes:

Expenditure overruns are common in business , particularly where those businesses rely heavily on estimates to determine their budget. Clear, accurate insights into these expenditures and the ability to forecast them will provide companies with an opportunity to keep spending under control.

Tips for achieving outcomes:

Cash management software can provide a visual dashboard of key financial metrics to show business performance at a glance. Cash management software also enables insights into a range of metrics including income, expenses, cash transactions, average time to get paid and average time to pay suppliers.

It also shows important financial information such as a company's balance sheet and how much cash is available. Cash management solutions allow businesses to easily identify trends and evaluate business metrics, for example the option to see the impact of COVID-19 on revenue compared to the same period the previous year.

Tips for achieving outcomes:

Many organizations suffer due to poor cash management. A weak structure or outdated financial software is often at the root of inefficient cash management processes. But there are other key reasons why a cash management system fails:

Poor understanding of the cash flow cycle

Cash management involves a clear understanding of the timing of every cash transaction, such as when to pay for accounts payable and when to purchase inventory. During periods of rapid growth, a company can end up running out of money because of over-purchasing inventory, yet not receiving payment for it.

Lack of understanding of profit versus cash

Companies can generate profits on their income statement and at the same time, be burning cash on the cash flow statement. Generating revenue does not automatically mean that the cash has already been received, so a rapidly growing business requiring a huge amount of inventory may be generating plenty of revenue but not immediately receiving positive cash flows on it.

Poor capital investments

Companies may allocate cash capital to projects that ultimately don't generate sufficient or anticipated return on investment - or sufficient cash flows to justify these investments. In this case, the investments will be a net drain on the cash flow statement, and eventually, on the company’s cash balance.

Insufficient cash management skills

It's crucial that cash management systems have managers at the helm who have the necessary skills to understand every aspect of cash management. These skills include the ability to optimize and manage working capital, a clear knowledge of accounts receivable, a real time view of current liabilities and the cash reconciliation process. Acquiring the necessary skills, to manage cash flow means discipline and putting the proper frameworks in place to ensure the receivables are collected on time and that transferring funds for accounts payable is not done before it's needed.

Outdated manual and error-prone cash management processes

Trying to execute individual cash management related tasks can lead to entry errors and a lot of time wasted. Consolidating, inputting and checking the validity of data takes up time that could be better allocated to strategic endeavors. The main obstacles in the reconciliation process are payment processing times and lack of information transmitted with payments.

Standardization, centralization and automation

It can be extremely difficult to standardize, centralize and automate cash management processes when there are multiple banks, ERPs, payment systems and processes to operate. Without a centralized system to synchronize, standardize and automate various systems, the cash management processes can be hindered.

Cross-border payments and currency fluctuations further complicate cash management. Cross-border accounts receivable can be costly and complex without proper cash workflows in place. The top challenges associated with cross-border receivables fall into three broad areas: reconciliation, currency-related complexities and sub-optimal payment terms. Consequently, currency rate fluctuations can negatively affect a company's profit.

Constantly changing laws, regulations and employment practices can make compliance difficult. Fraud, negligence, and lawsuits can occur when a business is not compliant and lacks the internal controls to prevent these things.

In today’s increasingly competitive business environment, companies need whatever edge they can get. That’s especially true when it comes to improving free cash flow. Of course enhancing accounts receivable, accounts payable and inventory management processes are all priorities, but so too is adopting a well thought out working capital strategy.

Enhancing cash flow management puts companies in the best position to improve operational efficiency, better manage cost of capital, mitigate operational and financial risks and improve shareholder value. To realize these benefits, a clear understanding of working capital best practices is essential, so that organizations can adopt a robust cash management culture.

Here are some of the key cash flow management best practices that any organization can adopt:

Close monitoring of cash flow metrics and KPIs

Cash flow metrics are measures of information found on financial statements. KPIs, on the other hand, give more insight and add meaning to the metrics. For example, seeing a metric of net income can be useful, but it becomes far more meaningful when factoring in other information, such as performance over time or how assets relate to liabilities, etc.

KPIs for cash flow are financial metrics that guide management and stakeholder decision-making. Everyone involved with treasury management should have access to these measurements fairly quickly and easily. We'll look at specific cash flow metrics and KPIs to be aware of in more detail later in this guide.

Carry out frequent projections

Closely monitoring key cash flow data or variables allows better, more accurate, up-to-date projections of future cash flow. This can go a long way towards keeping a business out of financial trouble.

It's important when forecasting sales and expenses for a given period to factor in historical figures, such as customer payment histories, industry norm, averages and trends, plus current economic and business conditions. Project monthly cash inflows and cash outflows during the period, comparing and updating the budget based on actual monthly performance.

Have an emergency backup plan

The COVID pandemic has left a clear message in its wake. Organizations need to consider a worst-case scenario of a cash flow crisis. A clear, well thought out back-up plan can provide peace of mind and a source of reserve cash, or when to transfer funds in times of need.

Grow carefully

Growing a business too quickly can be highly risky. Selling more means spending more. If the amount of time between the increased cash outlay and increased sales is too long, businesses could find themselves starving for cash. Business growth involves taking precautions like identifying financial risk, and having a business growth plan in place that avoids long delays between cash outflow and inflow, and that pays very close attention to managing cash.

Invoice quickly

A good cash management system is dependent on avoiding any delays in invoicing clients and customers, as this adds to waiting time to receive payments.

As mentioned earlier, cash flow metrics and KPIs reveal a lot about a company's financial well-being and potential. Investors can use figures from financial statements to calculate some of these metrics, helping them to understand how healthy a company's bank accounts are.

For business owners and stakeholders, KPIs give valuable insights into important decisions. For example, making a decision to pursue new product lines or re-evaluating internal cash flow processes like accounts receivable.

Here are 10 of the most important cash flow metrics and KPIs to be aware of:

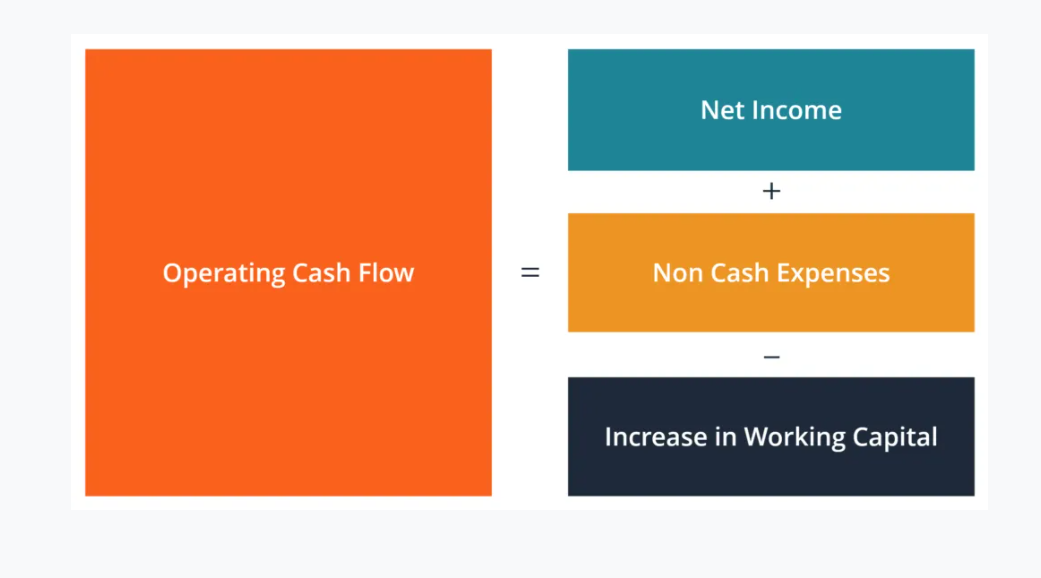

Operating cash flow

Operating cash flow (OCF) is the movement of money into and out of a business. It’s usually listed first on the cash flow statement and is sometimes listed as “cash flow from operating activities” or “net cash generated from operations.” This metric does not include revenue from interest or investments. A solid operating cash flow is enough to support the business's activities on its own without additional loans or outside investment.

Working capital

Working capital is a measure of liquidity, indicating how quickly a business can generate cash. Short-term investments that could be converted to cash in less than a year, cash and accounts receivable all help inform this metric. Additionally, liabilities such as accounts payable will come into the formula. Your liabilities and assets should be listed on your balance sheet. Express this metric as a ratio.

A current ratio of working capital greater than 1 means that a company can pay its current liabilities.

For example, a company's balance sheet has $80,000 in current assets, accounting for its cash, accounts receivable and inventory. It has $40,000 in liabilities, considering its accounts payable, short-term debt, recent notes payable, and accrued expenses.

This company’s working capital ratio = $80,000 / $40,000 = 1:2. This result shows this company has almost $2 in assets for every $1 in liabilities. Generally, a working capital ratio of less than one is taken as indicative of potential future liquidity problems, while a ratio of 1.5 to two is interpreted as indicating a company on solid financial ground in terms of liquidity.

Forecast variance

Companies can predict future financial positions with forecasts. Forecast variance, also known as the variance formula, shows the difference between the forecast and the outcome, and is expressed as percent. Tracking over time helps organizations understand and improve forecast accuracy.

Days Sales Outstanding (DSO)

Sometimes known as debtor days, days sales outstanding (DSO) reflects the average number of days to receive payment for sales. A low DSO means that buyers are paying your company for services or goods quickly. A high DSO could indicate issues with collections, which can impact your cash flow.

Days Payable Outstanding (DPO)

Also known as creditor days, days payable outstanding (DPO) is the average time it takes a company to pay its invoices or accounts payable. A greater number of DPO could also mean higher cash balances. However, excessively high DPO means that companies are at risk of losing their creditors or good credit terms. DPO that’s too low means that a company is not taking advantage of its credit period.

Accounts receivable turnover

Also known as debtor turnover ratio, the, accounts receivable turnover gives insight into the efficiency of a company's debt collection. High AR turnover indicates a company is good at collecting from its customers. The more times a business turns over accounts receivable, the more money it collects. Similarly, low AR turnover means a business either has difficulty collecting from customers or that is offering payment terms that are too flexible.

Accounts payable turnover

Also known as the creditor's turnover ratio, accounts payable turnover is the number of times a company pays its creditors in a given period. This metric is a measure of short-term liquidity.

Current ratio

A company's ability to pay off its short-term liabilities is measured by the current ratio. For example, a large company reports (in millions) current assets of $45,000 and current liabilities of $39,000.

This company’s current ratio = $45,000/$39,000 = 1.15. This value means that this company is meeting its financial obligations but could improve.

Cash flow from operations

Cash flow from operations, or operating cash flow, is the amount of cash a company generates from its daily activities, such as selling goods or providing services, over a given time — often a quarter or fiscal year.

Free cash flow (FCF)

Free cash flow (FCF) is a figure that shows how much money is left over after paying short-term liabilities and purchasing property or equipment. The remaining funds can either be reinvested in the business or used to pay dividends. Free cash flow shows how much surplus cash flow is available after operating expenses and capital expenditures.

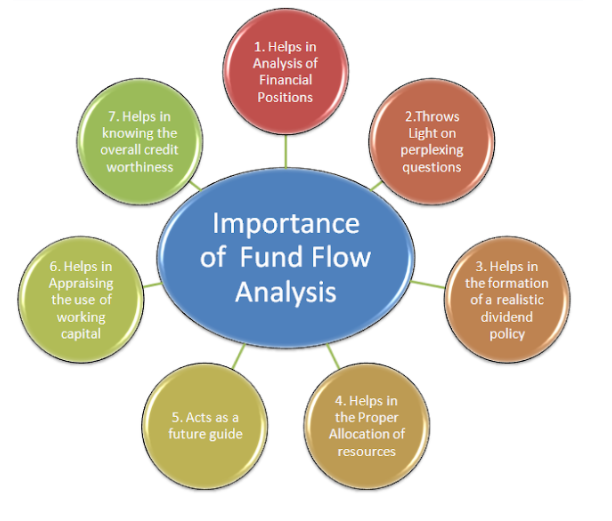

A fund flow statement is another relevant part of an efficient cash management system. It reveals the reasons for changes or inconsistencies in the financial position of a company between two balance sheets. Fund flow statements portray the inflow and outflow of funds - or the sources and applications of funds over a particular period. A fund flow statement also identifies changes in the status of working capital of a company. There are two types of inflows of funds:

Fund flow statements are used to show movement and activity related to both long-term and short-term funds by revealing:

While a profit and loss and balance sheet will show a company's financial position, it will not explain the reasons for fluctuations or variations in within the company's financial or cash position. So a fund flow statement is important because a profit and loss and balance sheet will depict two sets of figures - the current and previous year - but will not explain why movement has happened.

Read our guide to fund flow statement uses and benefits here

An efficient cash management system is only as good as the tools used to monitor and track its performance. With visualizations to better understand information and track KPIs and metrics, cash management performance solutions can provide real-time data in easy-to-interpret dashboards.

Choosing which KPIs to display will vary with company size, industry, etc. Some of the most common include:

These metrics give companies a quick look at financial position and could indicate if there are adjustments that need to be made.

Disasters like COVID-19 show that banks, financial institutions and businesses need to react fast when it comes to maintaining business continuity. With immediate visibility into current and projected cash and liquidity positions organizations are undoubtedly in a better position to manage cash flow and business operations, or transfer funds when necessary.

Monitoring cash flow visibility is extremely important to every business. Real time dashboards display live data that can make cash flow analysis as easy as pressing a button to generate reports. Senior management can then use this cash flow analysis to provide them with the tools to make better informed financial and risk assessment decisions. The ability to view an organization's entire payments ecosystem provides management with solutions to problems, which ultimately leads to an increase in profitability.

Find out more about monitoring cash flow visibility here

IR Transact simplifies the complexity of managing modern payments ecosystems, bringing real-time visibility and access to your payments and cash management systems.

Transact can help give organizations unparalleled insights into cash flow analysis, transactions and trends to help turn data into intelligence, and assuring the payments that keep you cash flow positive.

Businesses can gain unlimited access and insights into money flows, customer usage data, and end-to-end transaction performance metrics, offering a thousand points of reference, from a single point of view.

Through valuable data insights, led by information and payments data, a business can improve profitability, optimize revenue and cut costs. Without transaction data and analytics to get clear visibility into the payments environment, a business wouldn't be able to identify transaction performance issues, or detect fraud and other anomalies.

Services would be disrupted, repair times and troubleshooting processes would also be derailed, and the risk of bottlenecks for services like online banking, POS or mobile payment networks would increase.

Payment analytics tools allow a business to take historical data and apply it to things that are happening to a business right now. This applies to sales and payment processing or any online services in the payment space. Analytics are as important to the payment industry as any business, if not more so. In order to improve your payment services and performance, it's necessary to understand customer profiles and behaviors - as well as having insights to providers' risk profiles.

Find out more about why your company should do a cash flow analysis here